In November 2023, residents of Douglas County, CO were asked to vote on ballot measures 5A and 5B. 5A and 5B would raise property taxes to provide additional revenue to Douglas County School District (DCSD) for operational and capital expenses, respectively. 5A sought to raise $66M in annual revenue for the district, primarily to fund salary increases for teachers and other DCSD employees. Voters passed 5A but rejected 5B.

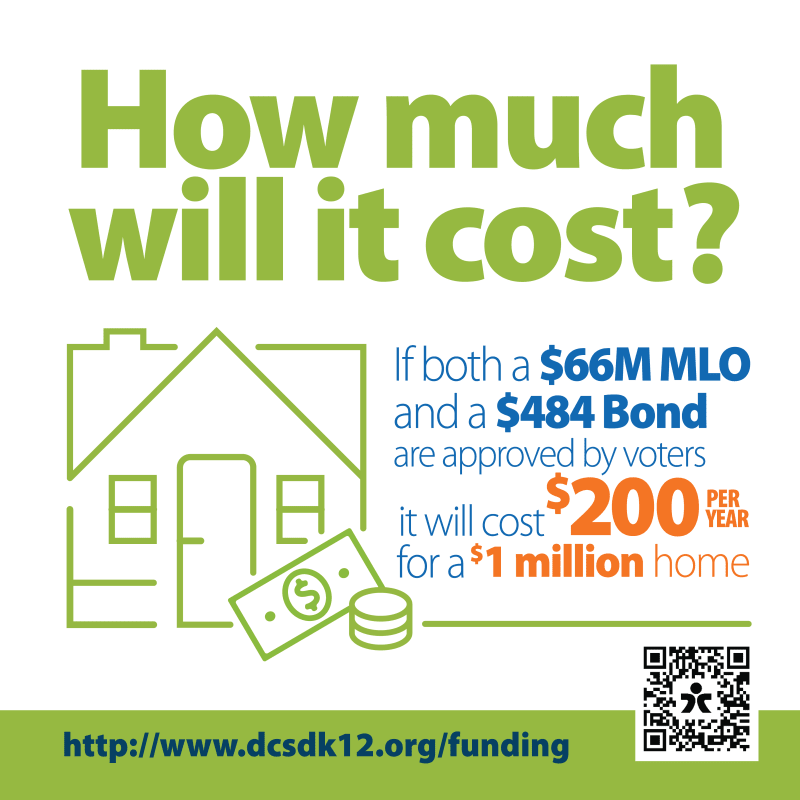

DCSD told residents that passing both 5A and 5B “would increase property taxes by $200 per year for a one-million-dollar home”. In alternate phrasings such as here and here, residents were told 5A and 5B would "cost $200 per year for a $1 million home".

As predicted, taxes actually increased just over $400 for a $1M home, and that’s with only 5A passing. Had 5B also passed, taxes would have increased even more, and thus be even further away from the stated $200.

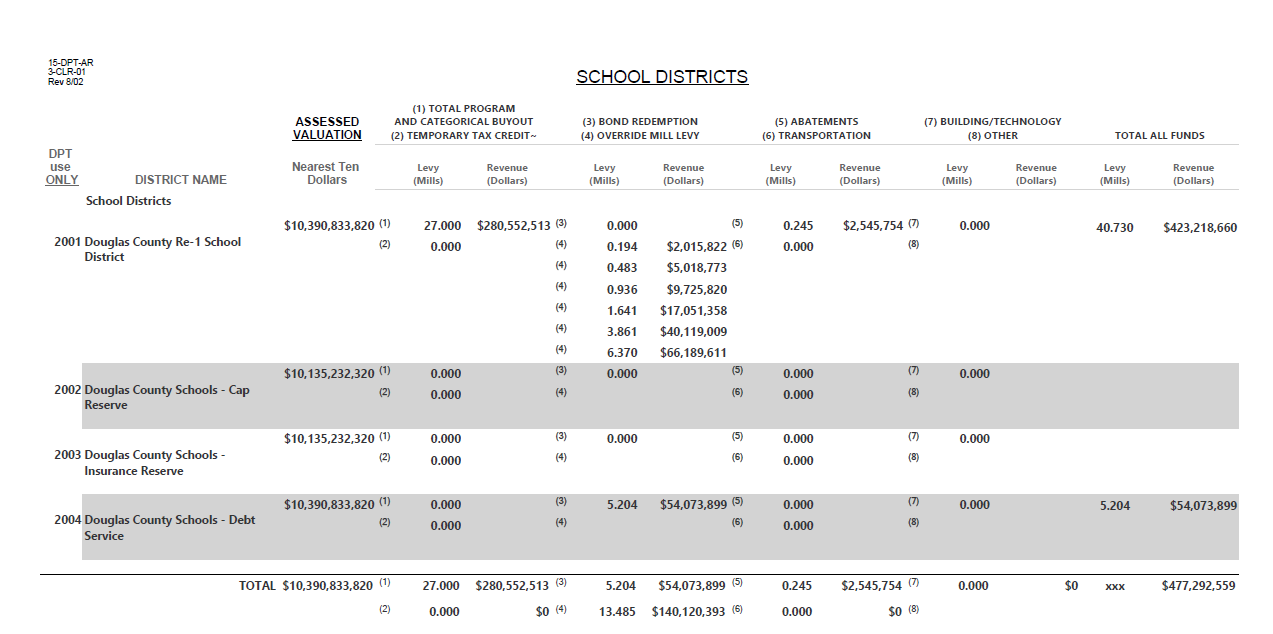

5A will be funded via an increase to DCSD’s Mill Levy Override (MLO). More precisely, 6.370 mills were added to the total Override Mill Levy (which includes MLO increases approved by voters in previous years) to raise $66,189,611 in revenue for the district:

A full copy of certified mill levies in Douglas County for 2023 can be found in the Agenda Packet accompanying the January 17 meeting of the Board of County Commissioners.

Below is a table showing a selection of properties throughout the county with their 2023 property values, the tax burden which results from the 6.370 mills, and the tax burden per $1M home value increment.

| District | 2023 Property Value | Tax Burden from 5A | Tax Burden from 5A per $1M Property Value Increment |

|---|---|---|---|

| A | $883,351 | $354 | $401 |

| B | $1,459,251 | $599 | $411 |

| C | $920,000 | $369 | $401 |

| D | $837,447 | $334 | $399 |

| E | $1,107,171 | $449 | $406 |

| F | $661,500 | $259 | $392 |

| G | $752,078 | $297 | $395 |

For the properties in the table above, the average cost for 5A per $1M property value increment is $401.

If you are a Douglas County homeowner, here’s how you can see how much 5A impacted your property taxes:

- Go to the Assessor's website.

- Enter your address in the Property Search box.

- Click on the link that says “2023 Est. Taxes”; this should open a new tab.

- In the new tab, look at the “Taxable Assessed Value”.

- Multiply the “Taxable Assessed Value” number by 0.00637.

Is the result higher or lower than what you thought it would be, based on what you heard about 5A and 5B prior to the 2023 election?

If you'd like to get in touch to discuss this article, please reach me via email at .